income tax plus worcester ma

EITC is a FREE refundable federal tax program that reduces the amount of income tax owed by low- to moderate-income working individuals and families. See reviews photos directions phone numbers and more for the best Accountants-Certified Public in Worcester MA.

Book Your Appointment Mobile Appointment Check-in.

. Worcester MA 01604 508 425 6388. State leaders expect potential budget-crippling 575M tax revenue shortfall documents show. You should report your local income tax amount on line 28 of form 502.

Based on the real property tax rate of 0845 net property taxes increased by 4232386. Personal Property Tax About Tangible or physical property that you can move easily is personal property. Track your tax return status Track your refund status Upload files W-2 1099 etc.

MEET INCOME TAX PLUS. Need to find a different location. Use our free directory to instantly connect with verified State Income Tax attorneys.

We focus on whats FAST and HELPFUL. Worcester MA 01604. Accessible via WRTA Bus Line.

Preliminary tax bills are issued on July 1 and October 1. All in your Wednesday June 7 Worcester Sun. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

You can file an application with the Assessors Main Office in Room 209 City Hall 455 Main Street Worcester MA 01608. If you dont have an account with us yet click below. The average Income Tax Senior salary in Worcester MA is 93128 as of September 27 2021 but the salary range typically falls between 85247 and 102757.

Browse 94 Income Tax vacancies live right now in Worcester. We focus on whats FAST and HELPFUL. 118 Shrewsbury St Worcester MA 01604 508 425 6388.

MEET INCOME TAX PLUS. Send and receive messages Make payments. Ready To Work Together.

Prices to suit all budgets. 490 Union Avenue Telefone. Real property tax on median home.

The preliminary tax is calculated on the basis of the previous years taxes divided by four. Find pros you can trust and read reviews to compare. Holloway Income Tax can be contacted at 508 756-9280.

Find Income Tax jobs in Worcester on Jobsite. MEET INCOME TAX PLUS. 118 Shrewsbury Street P.

Sales Tax State Local Sales Tax on Food. Book your appointment We have 3 convenient locations. 371 Somerville Ave Somerville MA 02143 617 666 9992.

Track your tax return status Track your refund status Upload files W-2 1099 etc View your tax return. See reviews photos directions phone numbers and more for Putnam Ohio Tax Exempt Income Fund locations in Worcester MA. The City of Worcester issues real estate tax bills quarterly.

If you dont have an account with us yet click below. Book Your Appointment Mobile Appointment Check-in. If you dont have an account with us yet click below.

The abatement period is set by Massachusetts General Laws as 30 days from the mailing of the Third Quarter actual tax bill usually January 2 through February 2 each year. Para facilitar o atendimento a Income Tax Plus possui escritórios em três cidades de Massachusetts. MEET INCOME TAX PLUS.

Headquarters 100 Concord St Framingham MA 01702-8328 Email this Business. Income Tax Plus specializes in tax preparation and consultation services. Holloway Income Tax is located at 23 Burncoat St Worcester MA 01605.

371 Somerville Avenue Telefone. Get Holloway Income Tax reviews ratings business hours phone numbers and directions. The ITIN will allow you to file a federal income tax return in absence of a Social Security Number.

Compare the best State Income Tax in Massachusetts. The accounting tax preparation and payroll services industry in the United States is forecast to generate approximately 60 billion in revenue by 2018. Ad Real prices from local pros for any project.

ITIN APLLICATION FILING SERVICE. The local income tax is calculated as a percentage of your taxable income. We focus on whats FAST and HELPFUL.

We focus on whats FAST and HELPFUL. If you dont have. See reviews photos directions phone numbers and more for Income Tax Plus locations in Worcester MA.

The actual tax is calculated from the new assessment and tax rate minus the preliminary tax divided by two. The Massachusetts state income tax rate will fall slightly in January the third-to-last step in the tax rates odyssey from 595 percent in 1999 to its potential nadir two years from now at the. Tangible personal property is subject to personal property taxation unless exempt by statute.

See reviews photos directions phone numbers and more for income tax plus locations in worcester ma. Who is responsible for the taxes if a property is. Home Programs About Us News Contact Us Join Our Email List Donate.

How To Calculate Cannabis Taxes At Your Dispensary

Community Action Agency Southeastern Ma Self Help Inc

Boston S Metco Program Is Fading Away The Atlantic

Charmin Ultra Soft Toilet Paper 9 Mega Rolls Walmart Com

What Is The Average Company Car Allowance For Sales Reps

Hotel In Fort Myers Beach Best Western Plus Beach Resort

Howie Carr Marty Walsh Urged To Run For 5m Plus Reasons

Affordable Insurance Policies For Massachusetts A Affordable Insurance

Awesome Iphone 6s Wallpaper Hd 241 Check More At Http All Images Net Iphone 6s Wallpaper Hd 241

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Westminster Place In Holden Ma New Homes By Fafard Real Estate

Income Tax Plus Tax Preparation

The Macroeconomic Implications Of Biden S 1 9 Trillion Fiscal Package

Income Tax Plus Tax Preparation

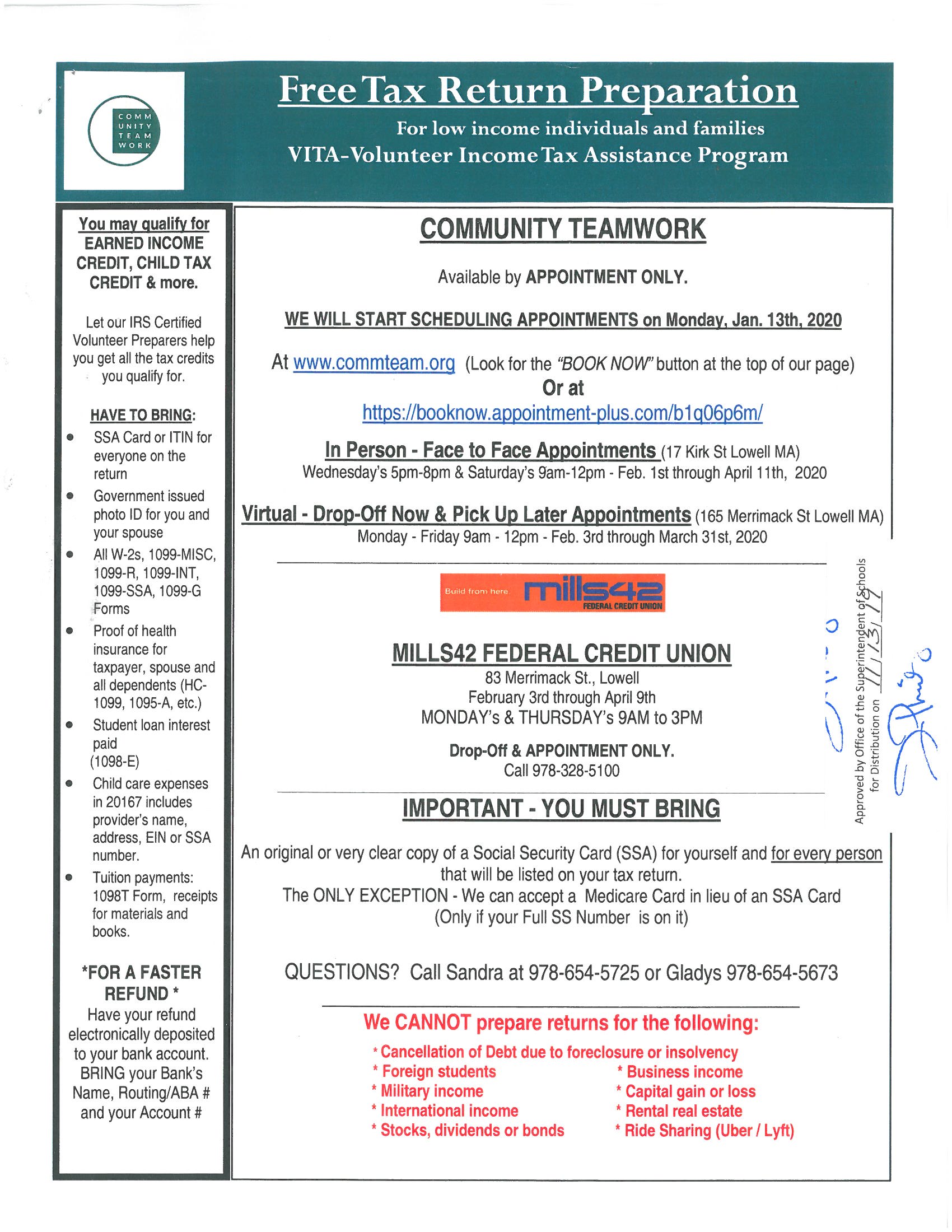

Join Us To Unveil Free Tax Prep And Salute Legislators Community Teamwork